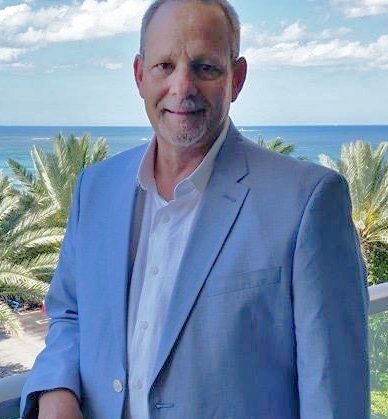

Neal Weiss - Franchise Consultant

California

For over a two decades, Neal Weiss has matched new and veteran franchise owners with some of the top franchise systems in the United States. His diverse background as a franchise executive in both privately held and publicly traded companies makes him ideally suited to help you understand the world of franchising. His goal of helping people achieve the rewards of business ownership is his goal as guides entrepreneurs through a franchise investigation in order to match their goals, talents and vision with franchises that are a perfect fit for them.

A transplanted New Yorker who now lives in Laguna Beach California, Neal studied Psychology at SUNY New Paltz but quickly realized his love for business and understanding people was best served in franchising. He has helped place hundreds of individuals in franchising over the years. He has ‘walked the walk’ and can tell you what you will go through, where the pot holes along the way are and how to successfully partner with a franchise system.

In addition to his extensive background in the development of scores of well-known franchise brands, Neal is an avid golfer who enjoys the many beautiful courses in Southern California. Today, Neal uses his decades of experience in franchising and assessing core skills sets to help entrepreneurs and first time business owners find the perfect business. With The Franchise Consulting Company, he has the ability to talk directly with you about how to structure your vision in franchising.

Thank you for contacting me.

I will get back to you as soon as possible.

Neal Weiss

The Franchise Consulting Company

Oops, there was an error sending your message.

Please try again later

Please try again later

CONTACT US

Let's Work Together

Thank you for you interest in The Franchise Consulting Company Dominican Republic.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later

Please try again later

© 2023 The Franchise Consulting Company | All Rights Reserved | Privacy Policy